Corporate tax reduction for Startups

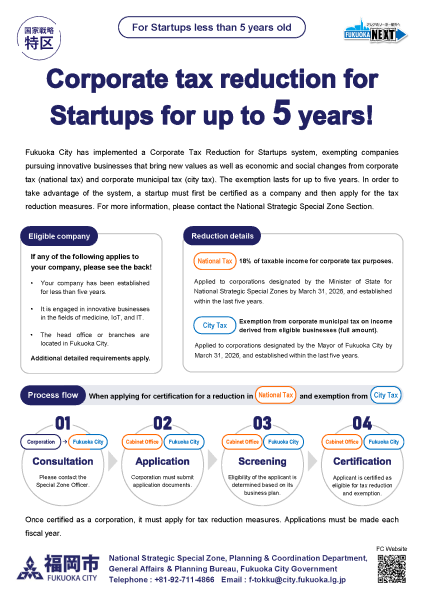

Fukuoka City has implemented a Corporate Tax Reduction for Startups system, exempting companies pursuing innovative businesses that bring new values as well as economic and social changes from corporate tax (national tax) and corporate municipal tax (city tax). The exemption lasts for up to five years. In order to take advantage of the system, a startup must first be certified as a company and then apply for the tax reduction measures. For more information, please contact the National Strategic Special Zone Section.

Eligible company

- Your company has been established for less than five years.

- It is engaged in innovative businesses in the fields of medicine, IoT, and IT.

- The head office or branches are located in Fukuoka City.

Additional detailed requirements apply.

Reduction details

National Tax

18% of taxable income for corporate tax purposes.

Applied to corporations designated by the Minister of State for National Strategic Special Zones by March 31, 2026, and established within the last five years.

City Tax

Exemption from corporate municipal tax on income derived from eligible businesses (full amount).

Applied to corporations designated by the Mayor of Fukuoka City by March 31, 2026, and established within the last five years.

Process flow

When applying for certification for a reduction in “National Tax” and exemption from “City Tax”.

Once certified as a corporation, it must apply for tax reduction measures. Applications must be made each fiscal year.

1 Consultation

Please contact the Special Zone Officer.

2 Application

Corporation must submit application documents.

3 Screening

Eligibility of the applicant is determined based on its business plan.

4 Certification

Applicant is certified as eligible for tax reduction and exemption.

Requirements

Eligible for this system are companies engaged in innovative businesses that meet the following requirements:

National tax reduction measures

- Establishment date

The date of its establishment is less than 5 years ago. - Location

The head office or main office is located within a National Strategic Special Zone.

City tax reduction measures

- Establishment date

The date of its establishment is less than 5 years ago. - Location

The head office or main office is located in Fukuoka City. - Business

(Target areas)

Medical, Specific IoT, Advanced IT

(Requirements)

The regulatory exceptions for the National Strategic Special Zone must be essential for the applicant.

(Business ratio)

The proportion of the company's businesses eligible for tax reduction measures must be approximately 50% or more of all its businesses. - Employment requirements

The company must hire permanent employees, including at least one Fukuoka City resident.

Other information

Leaflet

Related Links

Contact information

Department: National Strategic Special Zone, Planning & Coordination Department, General Affairs & Planning Bureau

Adress: 1-8-1, Tenjin, Chou-ku, Fukuoka-shi, 810-9620, Japan

Telephone: +81-92-711-4866

Email: f-tokku@city.fukuoka.lg.jp

東区

東区 博多区

博多区 中央区

中央区 南区

南区 城南区

城南区 早良区

早良区 西区

西区